Sartorius Stedim Biotech S.A. | Investor Relations

A Trusted Partner for the Biopharmaceutical Industry and Laboratories

Sartorius Stedim Biotech is a leading international partner for the biopharma sector. Our solutions are supporting our customers to develop and produce drugs safely, timely and economically. The Group has been annually growing by double digits on average and has been regularly expanding its portfolio by acquisitions of complementary technologies.

Reasons to Invest

We focus on the attractive biopharmaceutical market characterized by long‑term and stable growth trends.

Key Growth Drivers

- Growing world population

- Increasing incomes and better access to healthcare services in emerging economies

- Aging population and rise in age-related diseases in industrialized countries

Medical progress is also fueling growth, resulting in the ongoing development and approval of new biopharmaceuticals and in the improvement or expansion of indications for already existing active pharmaceutical ingredients. Therefore, a growing number of biotech medications are being approved for treatment of rare diseases considered incurable until now, and innovative cell and gene therapies are projected to further drive growth in the biopharma sector.

Sartorius Stedim Biotech has leading market positions in core technologies and is continuously expanding its portfolio by new, complementary technologies that help our biopharma customers develop and manufacture medications faster and more easily. Our strength in selecting suitable partners or acquisition candidates is based upon our in-depth understanding of applications. We are thoroughly familiar with our customers’ requirements and their entire value-added chains, and particularly understand the interactivity of the systems they use. Our innovation strategy is based on three pillars:

- Integration of innovations through acquisitions

- Alliances with partners

- Own product development

With sites in more than 30 countries, Sartorius Stedim Biotech is represented in all major biopharma markets. As part of a long-term investment program that is now well advanced, the company has been investing in the expansion of its research and production infrastructure for several years. In addition to expanding capacity, these investments are aimed at further diversifying and increasing the flexibility of the production network, Sartorius is well positioned to capture strong organic growth.

North America and Asia are the key focal areas of the regional growth strategy. The USA is the world’s largest market for bioprocess equipment. Yet because it is home to the company’s main competitors, Sartorius Stedim Biotech formerly had lower market share in this region than in Europe and Asia. By systematically strengthening its sales and service capacities, Sartorius Stedim Biotech has gained market share in North America in recent years and intends to expand this further.

The Asian market also offers significant growth potential for the company. Drivers are demographic change, increasing prosperity, rising government spending on health care and the expansion of the regional biopharmaceutical industry. To benefit from this dynamic development, the company has significantly strengthened its presence in this region.

Repeat business with sterile single-use products accounts for approx. 80% of the company’s sales revenue. These offer customers cost advantages, flexibility, and less resource usage, and thus a better ecological footprint compared with conventional processes employing reusable stainless-steel components.

The high share of recurring revenues is also bolstered by the strict regulatory requirements on the part of the customers. Because health authorities validate production processes as an integral part of an application for approval of a new medical drug, the components initially validated can be replaced only at considerable expense once they have been approved. Beyond this, the company’s broad and stable customer base that is primarily addressed directly through a specialized sales force also contributes to this favorable risk profile.

The bioprocess technology market is characterized by relatively high entry barriers arising in part from the biopharmaceutical industry’s strong degree of regulation and its technological complexity.

Acquisitions that are complementary to or extend the company’s strengths appropriately have been and will remain part of our portfolio strategy. Due to high innovation dynamics, the company considers further additions to be possible on an ongoing basis across the entire breadth of the product portfolio.

Acquisition Criteria

- Complementarity of technologies to our existing portfolio

- Strong market positioning, for example, through innovative products with unique selling propositions

- Integration capability

- Appropriate valuation

- Growth and profitability profile

For many years, we have firmly embedded sustainability at many levels in our business. To us, it means operating responsibly and nurturing long term relationships – with respect to customers, employees, investors, business partners and society as a whole.

Key Facts 2025

1 In constant currencies | 2 Underlying = excluding extraordinary items

2026 Outlook, Midterm Ambitions and Corporate Structure

Sartorius Stedim Biotech’s goal is to continue its profitable growth and systematically expand its position as a leading international partner for biopharmaceutical research and the industry.

The positive business performance in 2025 confirms the management’s assessment that the dampening short-term industry factors are losing momentum, while the structural growth drivers of the life science market are regaining importance.

“Heading into 2026, our industry is back on track – even if it has not yet returned to its long-term growth rates. Some uncertainties persist: from the pace of customer investment recovery to macroeconomic and geopolitical factors. Since the year is still young, we have set a broad guidance range to account for the continued high macroeconomic and industry-specific volatility. The lower end of the range reflects a cautious scenario in which market conditions weaken. However, we currently expect market dynamics to continue normalizing and positive trends to continue,” said René Fáber. “With our strong market position and resilient business model, we are well set up to address these challenges. Going forward, we will further sharpen our focus on customers, innovation and operational excellence to help our customers bring new therapies to patients worldwide and continue to grow profitably in 2026 and beyond.”

For fiscal year 2026, Sartorius Stedim Biotech expects sales revenue to increase by between around 6 and 10 percent in constant currencies, including a contribution of around 1 percentage point from US tariff surcharges. Growth will be mainly driven by the consumables business, while the equipment business is expected to remain at least stable. The underlying EBITDA margin should increase to slightly above 31 percent, driven by volume and scale effects (PY: 30.8 percent).

The ratio of capital expenditures to sales revenue is expected to remain at a similar level to 2025 (PY: 13.3 percent). This reflects the continued targeted investments in research and production capacities, technologies, and innovation supporting the Group’s mid-term growth ambitions. Excluding potential capital measures and/or acquisitions, management expects the ratio of net debt to underlying EBITDA to be slightly above 2 (PY: 2.38).

Due to the continued high dynamics and volatility across the life science industry, the forecast remains subject to greater uncertainty, which is reflected in the current forecast range. Potential additional US tariffs are likewise not included.

Forecasts have been prepared based on historical information and are consistent with accounting policies. All forecast figures are based on constant currencies, as in past years. Management points out that the dynamics and volatilities in the industry have increased significantly in recent years. In addition, uncertainties due to the changed geopolitical situation, such as the emerging decoupling tendencies of various countries as well as the trade policy framework conditions, are playing a greater role. This results in higher uncertainty when forecasting business figures.

Sartorius Stedim Biotech intends to continue its profitable growth course in the long term and expects to grow faster than the market. According to the new medium-term targets, the Group plans to achieve average annual growth in the low- to mid-teens percentage range over the five-year period to 2028 of which acquisitions are anticipated to contribute around a fifth. The underlying EBITDA margin is also expected to increase and reach above 35 percent in 2028. The margin target includes expenses of around 1 percent of Group sales revenue for measures to reduce the company’s CO2 emission intensity.

“Our goals remain ambitious as we anticipate ever-increasing demand for biopharmaceuticals and vaccines due to a growing and aging population, improved access to medicines in emerging markets, as well as rapidly expanding markets for biosimilars and cell and gene therapies. At the same time, there is a need for continuous innovation, not only to help bring the promises of new therapies to life, but to also support our customers’ sustainability efforts. With our broad portfolio we see ourselves excellently positioned to support our customers in their endeavors and to continue to outgrow the market,“ commented Fáber.

Forecasts have been prepared based on historical information and are consistent with accounting policies. All forecast figures are based on constant currencies, as in the past years. Management points out that the dynamics and volatilities in the industry have increased significantly in recent years. In addition, uncertainties due to the changed geopolitical situation, such as the emerging decoupling tendencies of various countries, are playing a greater role. This results in higher uncertainty when forecasting business figures

Sartorius Stedim Biotech is a globally operating company with subsidiaries in more than 25 countries and more than 10,600 employees worldwide. The parent company of the Sartorius Stedim Biotech Group is Sartorius Stedim Biotech S.A., headquartered in Aubagne, France.

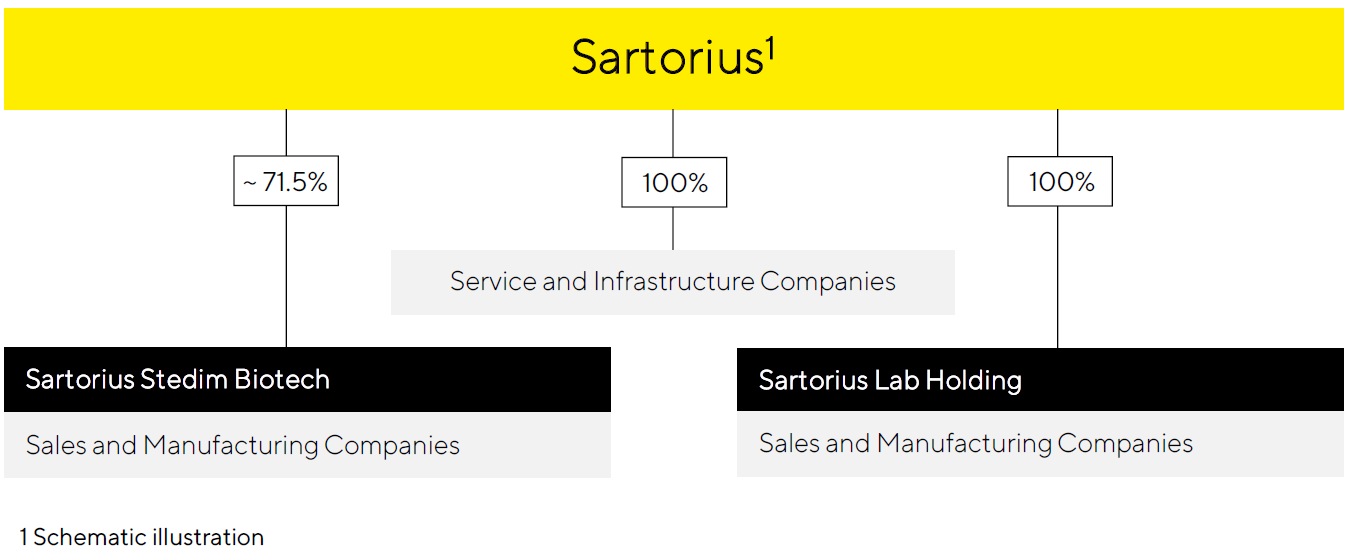

Sartorius Stedim Biotech S.A. is listed on the Euronext stock exchange in Paris. Approximately 72% of the share capital is held by Sartorius Holding, and around 83% of the voting rights of Sartorius Stedim Biotech S.A. are held by Sartorius AG.

Sartorius AG is an international leading partner for life science research and the biopharmaceutical industry and is headquartered in Göttingen, Germany. It is listed on the German Stock Exchange and operates two divisions: the bioprocess business as a subgroup under its parent corporation Sartorius Stedim Biotech S.A., and the laboratory business as a further subgroup.

Below you will find the legal structure of Sartorius AG, the parent company of Sartorius Stedim Biotech S.A.